What is Bounce Back?

We've all been there: you receive a dropping odds alert, find a price better than the sharp bookmaker's No Vig Price (NVP), place the bet, and then almost immediately the odds bounce back. Learn what this means and how to handle it.

We've all been there: we've received a dropping odds alert, we've found a price better than the sharp bookmaker's No Vig Price (NVP) at one of our soft bookmakers, we've placed the bet, and then almost as soon as the bet is placed, the odds bounce back!

Depending on the size of the bounce back, this is often a big indicator that the bet you placed doesn't have positive expected value.

That's especially considering we work under the assumption that the sharp bookmaker's price becomes more efficient as the start of the match approaches, and we are using that vig-free price as our efficient price and therefore 'line to beat'.

Of course, we want to minimize the amount of negative EV bets we place, so we need to understand what happened and where we went wrong, if we went wrong at all.

For more information on No Vig Price, see our No Vig Price (NVP) guide.

Why Do Sharp Bookmaker's Odds Bounce Around?

The sharp bookmaker's odds bounce around because it is trying to come to the 'right' price (fair odds + vig), and it is constantly receiving new information that causes its pricing mechanism to change its opinion on what that price is.

If you see a very volatile market that is bouncing around a lot, then you are looking at a market with a lot of uncertainty.

If the sharp bookmaker doesn't have confidence in its current price, then it will keep the amount of money that can be bet by a bettor on the market low. The amount that the bookmaker is allowing is called the limit.

In low-limit markets, the price is moved easily because the price is held with very little confidence by the bookmaker, so you see the odds bounce around a lot, leading to situations like the one I outlined at the start of this article.

As you know, we use the sharp bookmaker's NVP as the price to beat because it is the best in the world for a lot of markets at pricing, but that doesn't mean at any point in time in any given market that the sharp bookmaker's NVP is totally efficient, so we have to account for that.

That is what I am going to explain how to do throughout the rest of this article.

For more information on understanding limits and market efficiency, see our limit range filter guide.

How to Keep Overall EV Positive

To maintain positive expected value despite odds bouncing around, you need to implement the margin of safety principle.

This principle adjusts your required EV premium based on the efficiency of the market you're betting on.

Bet with a Margin of Safety

I'd argue that alerts for the sharp bookmaker's most and least efficient markets can both yield positive EV bets at your soft bookmakers. The difference is that the margin of safety we demand should be higher for the latter.

Let's say I receive an alert for an American football moneyline market, and the system is telling me the sharp bookmaker's NVP is at -110 (1.91), and I'm being offered odds of +100 (2.0). Then I feel confident placing a bet at those odds even though the EV is only 4.8%.

The reason I am confident this is a positive EV bet is because the sharp bookmaker is famous for being excellent at pricing American football moneyline markets, as shown by its high limits and low vig on these markets, which are both proxies for pricing confidence.

If I take a bet of this nature 1000 times, yes, some of them will of course fall on the wrong side of expected value, but in the long term, the sharp bookmaker is only going to be off in its pricing of American football moneyline markets by a margin far slimmer than 4.8%, so my yield should converge closely enough with my overall expected value.

Now, when it comes to a handball alert, I wouldn't take a bet with an EV of 4.8% using the sharp bookmaker's NVP that the system provides.

This is because the sharp bookmaker's average limit for a handball market hovers around $100, and its average vig is around 6.5%. These two indicators tell me that it's not confident in its handball prices, which means I'm not confident in its handball prices!

However, this lack of pricing efficiency doesn't mean that it isn't quicker than soft bookmakers to adjust to new handball market information, like a star player getting injured in the warm-up, so the dropping odds alerts are still valuable.

You just have to demand a larger margin of safety when you bet at the pre-adjusted odds.

Now, how large that margin of safety should be depends on how inefficient you deem the sharp bookmaker to be at pricing handball markets, and to be frank, I haven't got the data nor the time to go about figuring that to six decimal places or any decimal places for that matter, so this is going to be more of a gut call for most of us.

My advice is to err on the side of caution. Something like an 8% premium to the sharp bookmaker's NVP sounds about right to me. But depending on the confidence indicators, you might well push that up to above 10%.

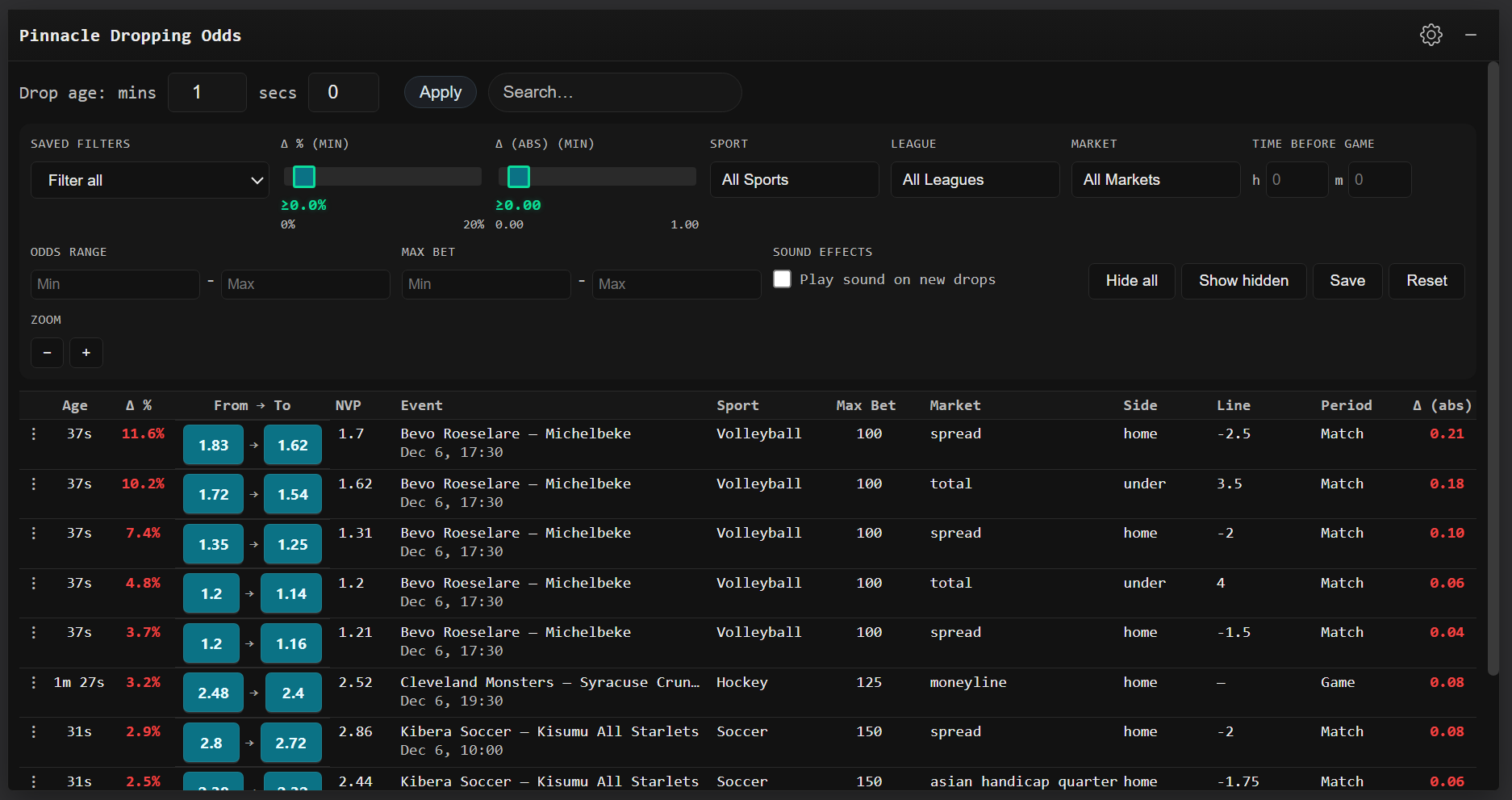

For more information on market efficiency, see our Pinnacle dropping odds manual.

What If I Don't Want to Bet on Low-Limit Markets?

Now, you might say, "Screw the margin of safety—I don't feel comfortable betting using lower efficiency prices in any circumstance."

The truth is you will be narrowing your opportunity field drastically, firstly because you will receive fewer alerts, and secondly because bookmakers are faster to react to drops in high-limit markets because their own limits are probably high, so they need to be more price sensitive to avoid heavy losses.

In short, your turnover will suffer, so your overall ROI will lag behind its potential.

Let's talk about the inverse of what I just said. Bookmakers are slower to react to market changes for low-limit markets, so these markets are a rich hunting ground!

In my personal opinion, if you completely exclude lower-limit markets from your betting strategy, then you are unnecessarily handicapping yourself.

I repeat once more: just adjust your margin of safety in proportion to the estimated market efficiency, which is indicated by the sharp bookmaker's limit and vig, to make sure you are a long-term positive EV bettor using the dropping odds strategy.

For more information on limit ranges, see our limit range filter guide.

Current EV

Current EV (Expected Value) is a real-time metric that helps you make objective decisions about your active logged bets. It continually recalculates the expected value of your bet using the sharp bookmaker's latest No Vig Price.

For example, if you place a bet at odds of +100 (2.00) when the sharp bookmaker's NVP was -111 (1.90)—giving you +5.26% EV—but the sharp bookmaker's odds then bounce back and the new NVP becomes +110 (2.10), your Current EV would update to show -4.76%.

This tells you that based on the latest market prices, your bet now has negative expected value.

Current EV is particularly valuable because:

- It updates automatically as the sharp bookmaker's odds change

- It helps remove emotion from cash out decisions

- It gives you a clear mathematical basis for comparing cash out offers

- It allows you to monitor your entire portfolio of active bets

This metric is especially useful when odds start bouncing around after you've placed a bet, as it helps you determine whether to hold your position or take a cash out offer.

For more information on expected value, see our expected value calculator.

Full Cash Out is Often Your Friend

If the market has turned against you after bet placement and your Current EV is negative while you're still being offered a full cash out, take the money and run 100% of the time.

This is sensible because your cash out EV is 0%, while if you let the bet settle, your EV will be in the negative.

Taking a full cash out when Current EV is negative means you're accepting a small loss now rather than risking a larger expected loss by letting the bet play out.

This is a mathematical decision, not an emotional one. The numbers clearly show that cashing out is the better option.

Use Partial Cash Outs Wisely

For partial cash outs, compare the loss you'll take as a percentage of stake to the Current EV.

If the loss from cash out is less than the expected value loss shown by Current EV, then take the partial cash out.

The inverse is true when the loss from partial cash out is greater than that of the expected value loss.

Here are some example scenarios:

- If your Current EV shows -10% but you're offered a cash out at -8% loss: Take the cash out. You're losing less than the expected value loss.

- If your Current EV shows +8% but you're offered a cash out at -10% loss: Keep the bet. The cash out loss is greater than your positive expected value.

- If your Current EV shows +8% but you're offered a cash out at +10%: Take the cash out. You're locking in more profit than your expected value.

The key is to always compare the cash out offer to your Current EV, not to your original bet EV or your emotions.

This mathematical approach ensures you're making optimal decisions based on current market conditions.

Ready to track your bets and monitor Current EV? Use FairOdds Terminal to place value bets, track your positions, and make data-driven cash out decisions based on real-time expected value calculations.

Bounce Back FAQ

What is bounce back in dropping odds?

Bounce back occurs when you receive a dropping odds alert, find a price better than the sharp bookmaker's No Vig Price (NVP) at a soft bookmaker, place the bet, and then almost immediately the odds bounce back. Depending on the size of the bounce back, this is often a big indicator that the bet you placed doesn't have positive expected value.

Why do sharp bookmaker odds bounce around?

The sharp bookmaker's odds bounce around because it is trying to come to the 'right' price (fair odds + vig) and is constantly receiving new information that causes its pricing mechanism to change its opinion on what that price is. If you see a very volatile market bouncing around a lot, you are looking at a market with a lot of uncertainty.

What is margin of safety in dropping odds?

Margin of safety is a key concept that demands a higher premium to the sharp bookmaker's NVP for less efficient markets. It allows for the bookmaker's mis-pricings and means you can place positive EV bets without having to only focus on high-limit markets. For efficient markets (high limits, low vig), you might accept 4-5% EV, while for inefficient markets (low limits, high vig), you should demand 8-10% or more.

What is current EV?

Current EV (Expected Value) is a real-time metric that helps you make objective decisions about your active bets. It continually recalculates the expected value of your bet using the sharp bookmaker's latest No Vig Price. If you place a bet at +5% EV but the odds bounce back and the new NVP shows -5% EV, your Current EV updates to show the bet now has negative expected value.

When should I use cash out?

If your Current EV shows negative and you're offered a full cash out, take it 100% of the time. For partial cash outs, compare the loss percentage to the Current EV loss. If the cash out loss is less than the expected value loss, take the partial cash out. If the cash out loss is greater than the EV loss, keep the bet.