5 Tactics to Reduce Variance

If you are value betting, you will experience downswings at some point. Learn 5 proven tactics to reduce variance and manage these inevitable periods of losses while staying profitable in the long run.

If you are value betting, then at some point you are going to have a bad run of losses.

Your first serious downswing might be at the start of your journey, a few weeks in, or maybe even months in, but one thing is for sure: it will come at some point.

Value betting is not like arbitrage betting—you are not guaranteed to win every time. Some bets will lose, and those losses can string together, but it's important to remember that this is something all profitable value bettors experience.

Understanding variance and how to manage it is crucial for long-term success in value betting.

For more information on understanding variance, see our variance in sports betting guide.

What to Do If You Start with a Bad Run?

First things first: don't panic. This is not unusual.

When I first started using the dropping odds strategy, I was in the red for the first week. The way I got through that was by double-checking the math.

I could see that my bets had positive expected value because I was beating the sharp bookmaker's No Vig Price by 5-10% every time I bet. Sure enough, it turned around just like the math told me it would.

Money is made over many thousands of bets, not just the first 100 or 200.

Value bettors reach statistical significance at around 2000 bets, meaning to be sure that a strategy is successful or not, you need to stick at it for at the very least a couple of months.

That being said, there are proven ways to reduce variance, so read on to learn the techniques I implemented to reduce it in my betting strategy.

For more information on statistical significance in betting, see our statistical significance guide.

How to Reduce Variance

Here are five proven tactics you can implement to reduce variance in your value betting strategy.

Each tactic addresses a different aspect of variance, and combining them can significantly smooth out your results while maintaining long-term profitability.

1. Bet on Shorter Odds

Whenever I speak to bettors who are just starting, whether that be with our software or not, I always tell them to keep their betting odds range low.

If you are placing value bets on things that are relatively likely to happen, then you are not going to string together so many losses.

While this will not have any effect on your profit at the end of the day, what it is going to do is smooth out your results, meaning you might even be able to get some sleep in between betting sessions.

I recommend you don't bet on anything above 3.0 if you are trying to minimize variance.

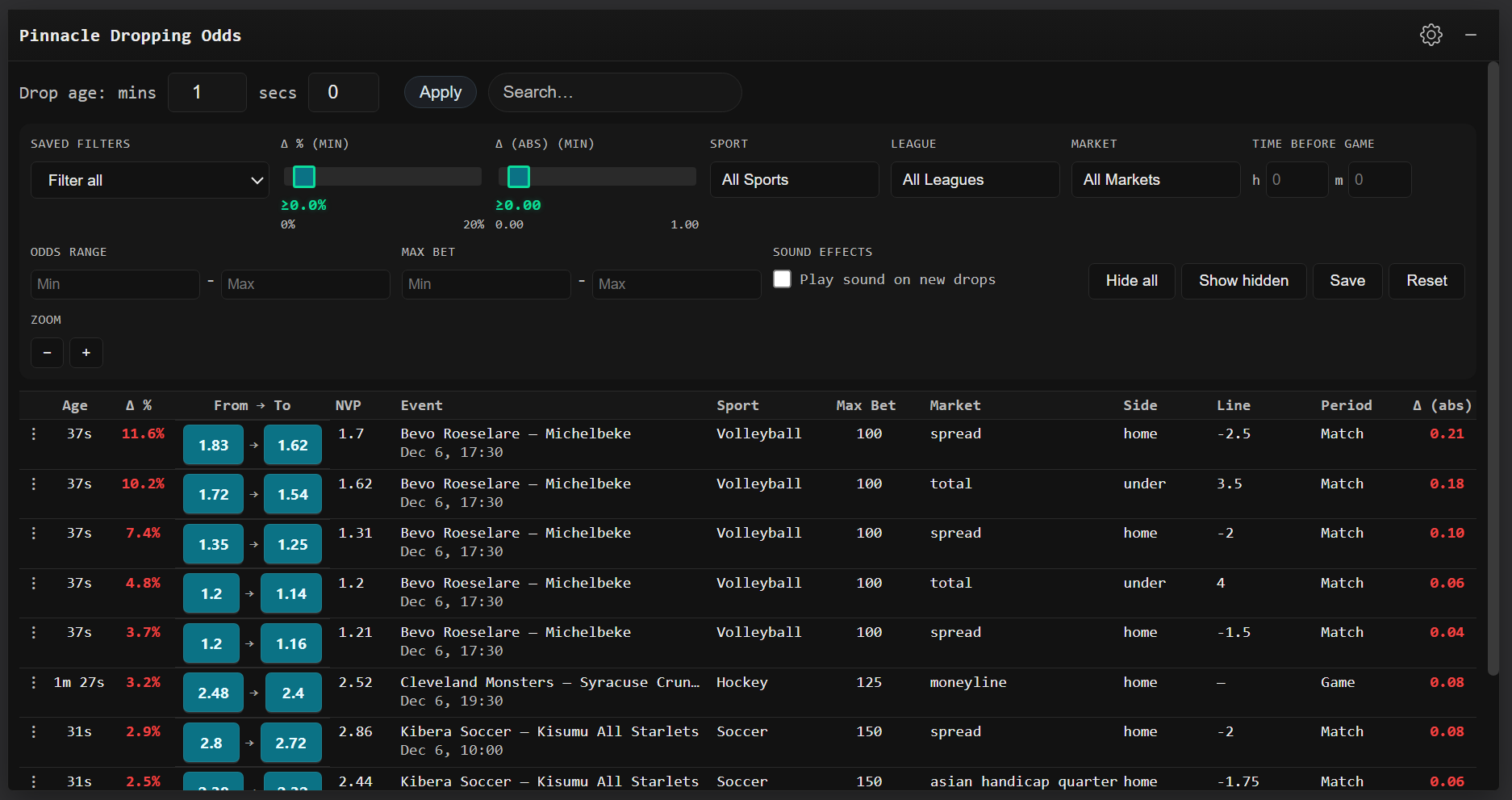

FairOdds Terminal allows you to set an odds range for your alerts to help you with this. You can configure your filters to only show alerts for odds within your preferred range.

Shorter odds mean higher win probabilities, which naturally leads to fewer consecutive losses and more consistent results.

For more information on configuring odds filters, see our tailoring alert configurations guide.

2. Place More Bets

Before writing this article, I asked value bettors, "How do you try and reduce variance in your betting?" and the overwhelming response was volume!

The more bets you place, the closer and sooner your results will converge with your mathematical edge.

This is based on the law of large numbers: as your sample size increases, your actual results will get closer to your expected results.

Increasing your betting volume means:

- Faster convergence to your expected value

- More opportunities to realize your edge

- Less impact from individual losing streaks

- Better statistical significance

To increase volume, consider:

- Betting on more sports and markets

- Opening accounts at more bookmakers

- Monitoring markets throughout the day

- Using multiple alert configurations

For more information on increasing betting volume, see our betting turnover optimization guide.

3. Don't Place More Than One Bet on the Same Outcome

Betting on the same outcome concentrates volume, which in turn leads to greater swings.

Do not double or triple bet on the same outcome even if EV has increased since your original bet if you want to minimize variance.

When you place multiple bets on the same outcome, you're essentially putting all your eggs in one basket. If that outcome loses, you lose multiple bets simultaneously, creating larger swings in your bankroll.

However, if the market changes and you are now offered positive EV on the opposite side of the outcome, then it is recommended you take the bet, as naturally the two sides are inversely correlated.

This is different from betting on the same side multiple times—betting on opposite sides can actually help reduce variance since they're negatively correlated.

Diversifying your bets across different events, markets, and outcomes helps spread risk and reduces the impact of any single loss.

4. The Kelly Formula Staking Strategy

One of the main advantages of having a good staking strategy is that it can reduce variance.

There are a few respectable staking strategies in circulation, but the most widely used to reduce variance is the Kelly Formula.

What the Kelly Formula is going to do is make sure that your bet size is optimal after taking into account the length of the odds and your mathematical edge.

You don't need to know the nitty-gritty maths of it—you just need to know how to implement it. Luckily there are many Kelly Formula calculators online that can help.

When I switched from fixed unit betting to the Kelly Formula, I noticed a significant reduction in my variance, so I recommend you give it a go too.

The Kelly Formula calculates the optimal bet size based on:

- Your current bankroll

- The odds offered

- Your estimated probability of winning

- Your edge over the bookmaker

If you want to reduce variance even further, then consider fractional Kelly (e.g., half-Kelly or quarter-Kelly), which uses a percentage of the full Kelly recommendation.

Fractional Kelly provides a more conservative approach while still benefiting from optimal staking principles.

For more information on Kelly Formula staking, see our Kelly Criterion Calculator and bankroll management guide.

5. Set a Maximum Bet

Deciding not to bet over a certain amount of money or a certain percentage of your bankroll on any one bet is going to limit your risk concentration and stop you from taking losses that you don't feel comfortable incurring in one go.

Setting a maximum bet helps protect your bankroll from excessive risk on any single wager.

This is especially important when using Kelly Formula or other aggressive staking strategies, as they can sometimes recommend very large bets that might exceed your risk tolerance.

Common maximum bet limits include:

- A fixed dollar amount (e.g., never bet more than $500)

- A percentage of bankroll (e.g., never bet more than 5% of your bankroll)

- A combination of both

Your maximum bet should reflect:

- Your risk tolerance

- Your bankroll size

- Your comfort level with potential losses

- Your long-term betting goals

This cap ensures that even during downswings, no single bet can cause catastrophic damage to your bankroll.

Stick to a Data-Driven Strategy

Sticking to a data-driven strategy is going to keep you focused on making logical bets.

One of the worst things bettors do is start to deviate from their data-driven strategy once they hit a bit of variance. I see it all the time, and it is painful to watch.

Using dropping odds alerts to find value at soft bookmakers is going to give you focus and a clear route to high ROI betting.

Making sure to beat the sharp bookmaker's NVP (No Vig Price) through upswings and downswings is vital.

Your strategy should be based on:

- Mathematical edge over the bookmaker

- Consistent filter settings

- Proper bankroll management

- Disciplined staking strategies

Don't abandon your strategy during downswings. If your math is correct and you're placing positive EV bets, the results will come over time.

For more information on maintaining discipline, see our complete value betting guide.

Managing Your Emotions

Managing your emotions during a downturn is one of the most important things you can do. Otherwise, you could end up straying from your data-driven strategy and start placing foolish, speculative bets in the hope of reversing things.

The reason I haven't put managing your emotions as a step to reducing variance is that if you start placing negative EV bets, then your downswing will start to become what is mathematically expected.

So it's important to make sure that you don't start getting emotional and placing non-data-driven bets when you experience a very normal downturn.

If you need to go for a walk, then go for one. If you need to take a short break from betting, that's fine. It will mean you can come back to betting with a clear frame of mind, and it will allow you to continue on your data-driven path with discipline.

Emotional betting leads to:

- Chasing losses

- Placing bets without proper analysis

- Deviating from your strategy

- Increasing bet sizes to recover losses

- Placing negative EV bets

All of these behaviors will hurt your long-term profitability and make variance worse, not better.

Remember: variance is a normal part of value betting. Even the most successful bettors experience downswings. What separates profitable bettors from losing ones is how they handle these periods.

For more information on managing emotions and maintaining discipline, see our bankroll management guide.

Ready to implement these variance reduction tactics? Use FairOdds Terminal to configure your alert filters, set odds ranges, and maintain a data-driven approach to value betting.

Variance Reduction FAQ

What should I do if I start with a bad run in value betting?

Don't panic—this is not unusual. Double-check the math to verify your bets have positive expected value. Value bettors reach statistical significance at around 2000 bets, so you need to stick with it for at least a couple of months. Money is made over many thousands of bets, not just the first 100 or 200.

How can I reduce variance in value betting?

There are 5 proven tactics: 1) Bet on shorter odds (below 3.0), 2) Place more bets to increase volume, 3) Don't place multiple bets on the same outcome, 4) Use the Kelly Formula staking strategy, and 5) Set a maximum bet limit.

Why should I bet on shorter odds to reduce variance?

If you place value bets on outcomes that are relatively likely to happen, you won't string together as many losses. While this won't affect your profit in the long term, it will smooth out your results and make the betting experience less stressful.

How does the Kelly Formula reduce variance?

The Kelly Formula ensures your bet size is optimal after taking into account the length of the odds and your mathematical edge. This optimal staking reduces variance compared to fixed unit betting. Many bettors notice a significant reduction in variance when switching to Kelly Formula staking.

Why shouldn't I place multiple bets on the same outcome?

Betting on the same outcome concentrates volume, which leads to greater swings and increased variance. Don't double or triple bet on the same outcome even if EV has increased since your original bet. However, if the market changes and you're now offered +EV on the opposite side, you can take that bet as the two sides are inversely correlated.